Joint mortgage affordability calculator

By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

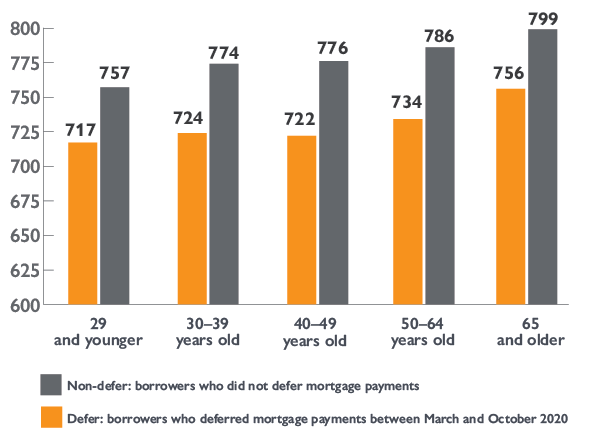

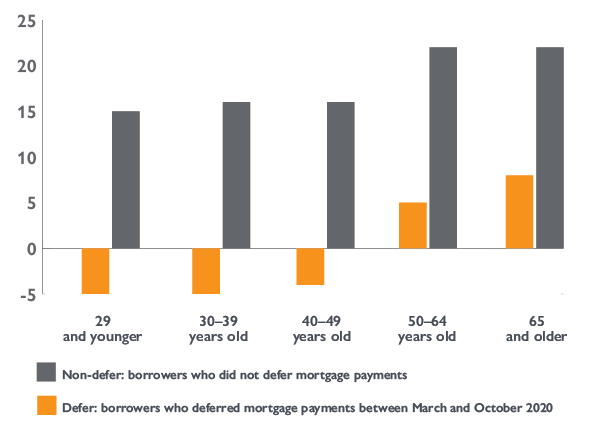

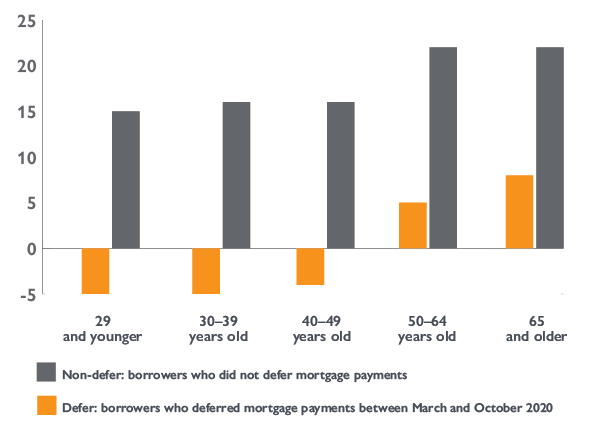

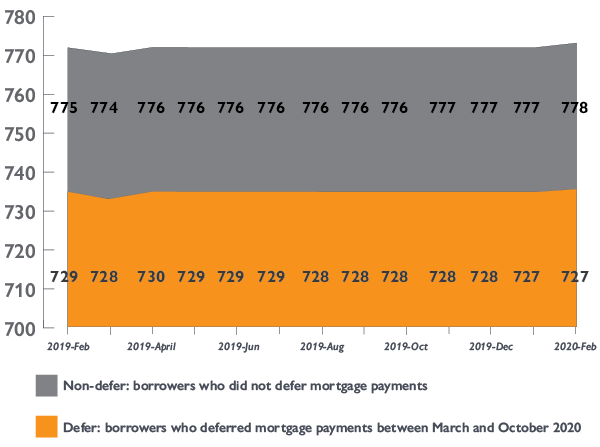

Consumer Credit Scores And Mortgage Deferrals Cmhc

Single or joint application.

. There are a number of issues to deal with including. Use Domain Home Loans home loan repayment calculator to get an estimate on how much your monthly home loan repayments might be if you were to take out a loan. Note that this not an official estimate.

If they dont have any commitments you can leave this. Mortgage refinancing is when a homeowner takes out another loan to pay offand replacetheir original mortgage. Or 4 times your joint income if youre applying for a mortgage.

Sorting out a joint mortgage is just one problem facing the surviving partner. For a further advance transfer of equity porting with additional borrowing and any post contract variation this calculator should be used for guidance only. How do mortgage lenders work out affordability.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Repayment method Capital and Interest. In the case of a marital breakdown of one of the joint account holders the account could be considered a matrimonial asset and divided accordingly.

Go to Understanding powers of attorney and joint accounts. Income 1 Income 2 Multiple Amount. The mortgage should be fully paid off by the end of the full mortgage term.

Factors that impact affordability. If you require an exact affordability result for any of these application types please call us on 0800 121 7788 selecting option 2. Our quick easy online mortgage decision in principle tool wont affect your credit.

The mortgage affordability calculator uses your salary details to give an idea of how much you may be able to borrow. Each lender will have its own way of calculating mortgage affordability. Pros and Cons of Getting a Mortgage With a Mortgage Company.

Affordability can only be assessed on submission of a full application for this type of lending. Trending Topics For Consumers. Knowing where you stand financially and how youre viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. Banks structure their own loan programs within guidelines set by Fannie Mae Freddie Mac FHA and VA. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

The Affordability Calculator will give you a quick estimate of how much your client can borrow. One of the most important things to be aware of is that your ex cant simply take your name off the joint mortgage or the title deeds without your knowledge or permission. When it comes to calculating affordability your income debts and down payment are primary factors.

Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. Annual salary Person 1 salary Person 2 salary. This calculator should not be used for additional lending portability or transfers of equity.

The most basic system is to use an income multiple as a rule of thumbThe reason income multiples are used is that looking at your mortgage to earnings ratio gives lenders a straightforward window into what you could be able to afford. At the end of the mortgage term the original loan will still need to be paid back. The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home.

Mortgage affordability 101 Its not what you can borrow its what you can afford In some respects the mortgage lending industry is working against your best interest. A mortgage refinance calculator can help borrowers estimate their new monthly. The actual amount will still depend on your affordability.

First they probably have access to a wider range of loan products than a full service bank. Use mortgage calculators renovation and maintenance tips. Joint auditors special examination report to CMHC board 2018.

With an interest only mortgage you are not actually paying off any of the loan. Learn more about powers of attorney and joint accounts. Joint auditors special examination report to CMHC board 2018.

Skip to content. Your affordability they may use a mortgage calculator to determine whether you can afford a mortgage alone. Term of mortgage.

Homebuying step by step. You lose privacy because your joint account holders can view your account transactions. Mortgage Affordability Calculator - for new business only.

Even if you have an amicable divorce or separation its always best to know what your rights and options are regarding any joint mortgage or shared property. There are some specific advantages to using a mortgage company for your loan. The mortgage repayment calculator can help you find a mortgage product to suit your requirements and calculate what your monthly repayments.

2836 are historical mortgage industry standers which are. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Find out what you can borrow.

CMHCs condominium buyers guide. Use our Residential Mortgage calculator to give you an indication of how much we could lend your clients. For instance affordability or credit issues etc there may be other options based on.

With a capital and interest option you pay off the loan as well as the interest on it. Residential Affordability Calculator Additional Borrowing Affordability Calculator. If you know your debt-to-income ratio before you apply for a car loan or mortgage youre already ahead of the game.

Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI. Total number of dependants Applicant 1 main income. Summary of the corporate plan.

CMHCs Insured Mortgage Deferral. While your personal savings goals or spending habits can impact your. Please ensure for joint applications that you only include joint commitments once.

Get the info you need.

Can A Joint Mortgage Be Transferred To One Person Haysto

Can A Joint Mortgage Be Transferred To One Person Haysto

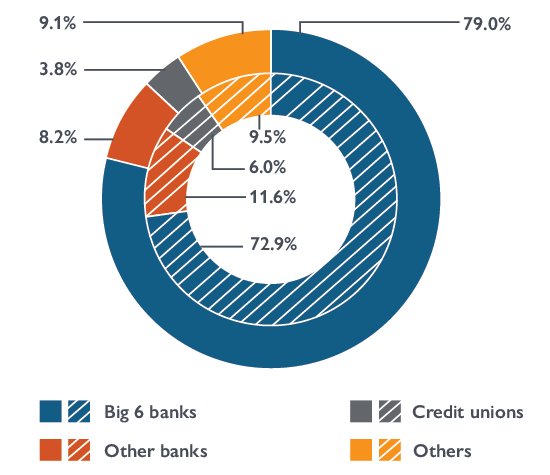

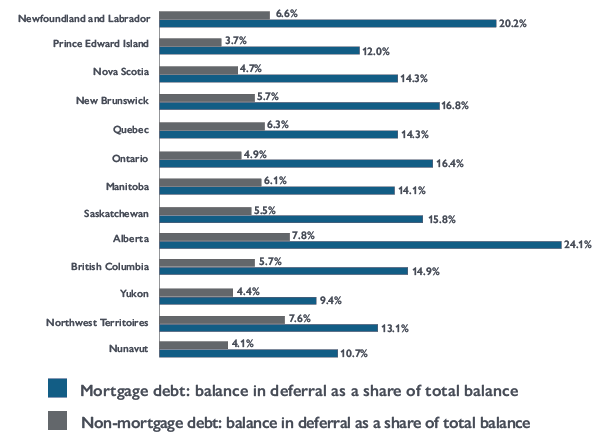

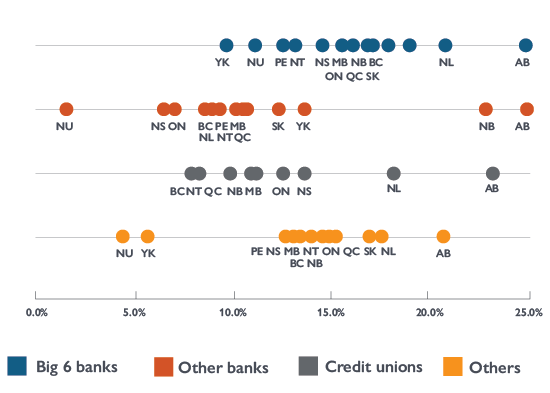

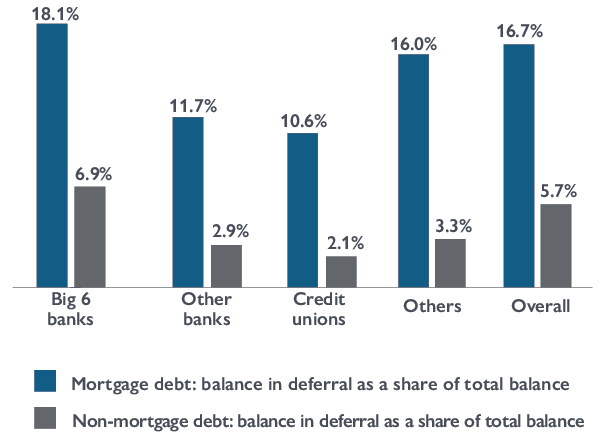

Consumer Debt Deferrals By Lender Group Cmhc

Can A Joint Mortgage Be Transferred To One Person Haysto

Mortgage Calculator How Much House Can I Afford

How Much Can I Borrow For My Mortgage Times Money Mentor

Can A Joint Mortgage Be Transferred To One Person Haysto

Can A Joint Mortgage Be Transferred To One Person Haysto

Rent Vs Buy Calculator Real Mortgage Associates

Can A Joint Mortgage Be Transferred To One Person Haysto

I Make 120 000 A Year How Much House Can I Afford Bundle

Consumer Debt Deferrals By Lender Group Cmhc

Consumer Debt Deferrals By Lender Group Cmhc

Consumer Credit Scores And Mortgage Deferrals Cmhc

Consumer Credit Scores And Mortgage Deferrals Cmhc

Consumer Debt Deferrals By Lender Group Cmhc

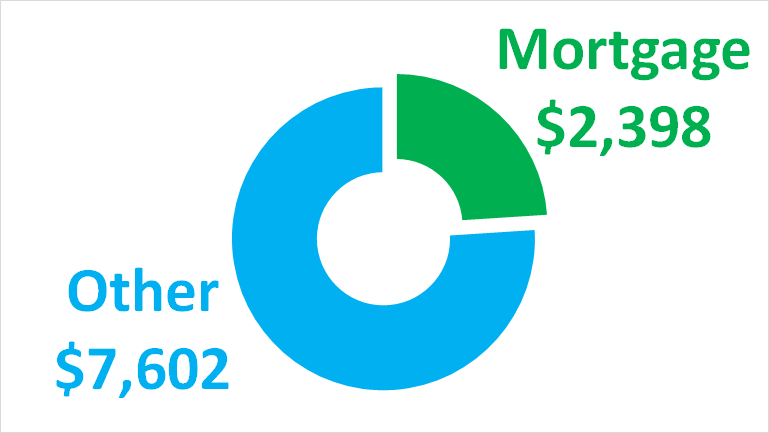

Personal Finance Manulife Bank